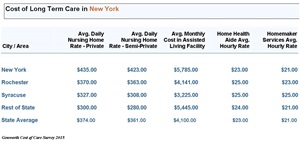

What is the cost of receiving long-term care in my NEW YORK community?

New York State Tax Credit

A credit is allowed equal to 20% of the premium paid during the taxable year for long-term care insurance approved by the Superintendent of Insurance, provided the policy qualifies for such credit pursuant to Section 1117. If the amount of credit allowable under this subsection for any taxable year shall exceed the taxpayer’s tax for such year, the excess may be carried over to the following year(s) and may be deducted from the taxpayer’s tax from such year(s) and applies to taxable years beginning on or after January 1, 2004.

To see if your state has a tax provision dealing with LTCi, please contact Elly Packer.

What are the costs of care in other areas around the country? View the US.gov site for state cost information, then return to CSA for enrollment.

Why is planning important? What are the odds I'll need care? What does Medicare cover? When is the best time to begin planning? Find answers to these questions and more.